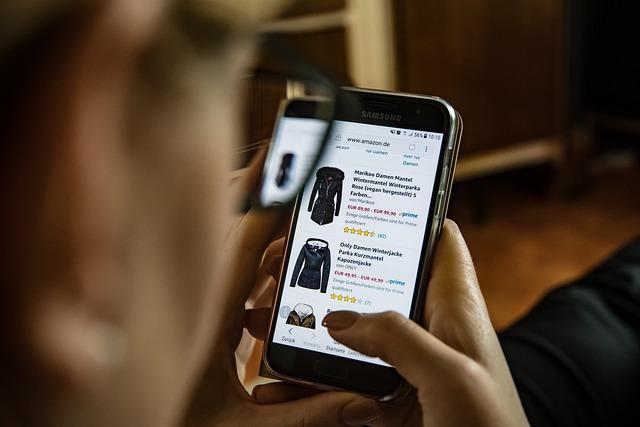

Explore the most accessible catalogues to get approved for, even with a low credit score. Discover tips and guidance to enhance your approval chances, enabling you to enjoy the perks of online shopping catalogues. Whether you aim to make a significant purchase or improve your financial standing, this blog has you covered. Find a range of bad credit catalogues. Enjoy the convenience of online shopping with these catalogues, even with poor credit ratings.

Accessing a Credit Account with a Bad Credit Catalogue

If you have reached this website, it is likely that you have a poor credit history that is preventing you from being approved for pay monthly catalogues. This article will provide guidance on how you can still be approved for online shopping catalogues, despite having a low credit score. It can be disheartening to have your application rejected by catalogue stores due to a low credit score. However, it is important to remember that everyone deserves a second chance.

Your credit history serves as a record of how you have managed your finances in the past, and your ability to repay credit. If you have a history of missed or late payments, this may negatively impact your credit score, causing difficulties when trying to obtain credit in the future. Unfortunately, this is just how things work. No one has a perfect financial history, but catalogue companies typically prefer to provide credit to individuals with a solid credit history. After all, why would they lend money to someone with a history of financial difficulty?

When it comes to getting approved for online shopping catalogues, there are a few things you can do to improve your chances. Firstly, make sure you are registered on the electoral roll at your current address. This helps verify your identity and can improve your credit score. Additionally, try to pay off any outstanding debts or credit card balances before applying for a catalogue. This shows that you are responsible with your finances and can help improve your credit score.

It’s also a good idea to check your credit file regularly to ensure there are no errors or fraudulent activity that could be affecting your score. You can do this for free through credit agencies like Experian or Equifax. Finally, consider applying for a catalogue that offers catalogue finance, as this can be an easier way to get approved if you have a poor credit rating.

Remember, not all catalogues are the same, so it’s worth shopping around to find one that suits your needs. With the convenience of shopping online, you can find a catalogue that works for you without leaving your home.

Sunshine Mobile

Sunshine Mobile: A Solution for Bad Credit Mobile Contracts Are you looking to upgrade to the latest Samsung Galaxy or iPhone model but are being held back by a below-average credit score? Look no further, as Sunshine Mobile offers mobile phone contracts with no credit history checks, meaning that even those with the poorest credit score are guaranteed to be accepted.

Sunshine Mobile, a UK-based company, focuses on a customer’s credit future instead of their credit history, making it easier for individuals with bad credit to obtain a mobile phone contract. The process of becoming a customer is simple and straightforward – simply visit their website at www.sunshinemobile.co.uk, create an account, and choose your desired phone from their extensive range of handsets.

After selecting your ideal mobile phone, you will need to join the company’s network for a period of 12 weeks by choosing one of their starter packages (SIM only or SIM plus start phone package). After regularly making payments for three months and proving yourself to be a responsible customer, Sunshine Mobile will deliver your new phone directly to you.

Sunshine Mobile offers flexible payment options, with their recently introduced Flexible Payment Plan allowing customers to set their own contract start date and re-schedule future payments. Payments can be made using either credit or debit cards.

From the latest iPhone and Samsung Galaxy models, to the P20 Pro and beyond, Sunshine Mobile offers a wide range of high-quality handsets for you to choose from. So why wait? Apply now and start enjoying the latest mobile technology, even with a bad credit score.

What you need to open a pay monthly catalogue personal account

If you’re seeking to apply for a Pay Monthly Catalogue Personal Account, you will need to provide some personal information. This information includes your full name, home address, date of birth, residential status, employment status, and details regarding your income. Once you submit your application, you will receive an instant decision.

If you have a history of credit issues, you may want to consider which Catalogue company to apply with based on the credit reference agency they use for credit checks. The table below lists the credit reference agencies commonly used by Catalogue companies for credit evaluations.

Shop Without Credit Checks: Discover Catalogues That Don’t Require Credit Checks

It’s important to note that catalogues with “guaranteed acceptance” or “no credit check” are not entirely accurate. Retailers who offer finance or credit usually require applicants to undergo a credit check before being approved. Therefore, be cautious if you come across a company claiming to offer a shopping catalogue without conducting a credit check.

When applying for catalogues, it’s essential to understand the payment terms and how they may impact your financial situation. While some catalogues may offer lenient payment terms, individuals with low credit scores or poor credit histories should be aware of the potential implications.

Additionally, these catalogues often provide personal accounts to manage purchases, making it easier to track expenses and repayments. Despite the assurance of “guaranteed acceptance,” individuals with a very bad credit rating or poor credit histories should approach these catalogues with caution.

Furthermore, catalogues with “guaranteed acceptance” often boast an extensive collection of products, ranging from fashion and electronics to home goods. However, it’s essential to consider your financial situation carefully before committing to purchases through these catalogues.

Responsible Lending with Catalogues: Ensuring Financial Safety and Security

In accordance with responsible lending regulations, catalogue companies must now comply with responsible lending policies. If you are managing your credit effectively, you may be eligible for a credit limit increase. On the other hand, if you have missed repayments on other credit accounts and are overextended, your credit limit increase request may be denied.

Some catalogues companies, such as Next PLC, may temporarily halt your credit limit if they observe changes in your personal circumstances that could impact your repayment capability.

Buy now pay later

Many catalogues offer the option of Buy Now Pay Later (BNPL), which allows you to postpone repayments for a specified period of time, usually ranging from 3 to 12 months. However, it’s important to note that not all credit catalogues offer BNPL, and those that do often have stricter acceptance criteria for individuals with a poor credit history.

Options for Pay Monthly Catalogues with Bad Credit

If you have a poor credit history or lack a credit rating, obtaining finance through a pay monthly credit catalogue can be challenging. However, it’s essential to recognize that catalogue companies often exhibit more flexibility in their credit approval process. If you have not applied for a prime credit catalogue yet, it may be a good option to consider. These catalogues offer an affordable alternative for individuals with varying credit types, allowing you to defer repayments or delay payment without severe penalties. Over the past few years, they have become increasingly popular as a convenient way to manage purchases and credit orders.

Application for a pay monthly catalogue declined

If your application for a pay monthly credit catalogue has been denied, it does not mean that all other companies will follow suit. The decision to grant credit depends on each individual’s credit standing, which may vary from one lender to another.

It is advisable to start by applying for finance with well-known home shopping catalogue companies. If you keep getting declined, you can then consider catalogues that specialize in providing credit for individuals with poor credit, which may come with higher interest rates but have a higher acceptance rate.

Missing Catalogues Payments

If you miss a payment deadline with your catalogue company, you may incur a late fee. It is important to be mindful of missed repayments, as this could negatively impact your credit score and future credit prospects. If you are facing difficulty in making payments, reach out to your catalogue company promptly. Many catalogue companies have dedicated support teams that can assist you in finding a solution. By keeping your catalogue company informed, you can help protect your account and credit rating.

Improve your Credit rating with a Bad Credit Catalogue

Using a catalogue that doesn’t require a credit check or is tailored for individuals with a poor credit history can play a crucial role in improving your credit score over time. These catalogues, such as pay weekly catalogues, offer a range of payment options, including credit or debit card payments, to suit your financial needs.

Making regular purchases and payments through these catalogues can demonstrate responsible financial behavior, which is reflected positively on your credit file. They often have minimum payment requirements and flexible payment methods, allowing you to manage your finances effectively.

While they may not offer the same credit limits as prime credit catalogues, they provide a practical short-term solution and can be a stepping stone toward being approved for a prime credit catalogue. Additionally, using these catalogues for bad credit can help you build a positive credit history, leading to more long-term credit solutions. Whether you’re shopping online or using home shopping catalogues, these options can be particularly beneficial if you have a very bad credit rating.

Compare Pay monthly Catalogues with credit

The following are credit catalogues with pay monthly options in the UK.

- Yes Catalogue

- Freemans

- Studio

- Flava

- Vertbaudet

- PW Card

- Witt

- La Redoute

- Kaleidoscope

- Bonprix

- Look Again

- Argos

- Swimwear365

Catalogue Credit Limits

We provide comprehensive information on the subject of Catalogue shopping. This includes comparing pay monthly catalogues, understanding catalogue credit limits, ways to enhance the chances of a credit limit increase, and how catalogue statements function.

Catalogues with instant credit

Get access to the latest in fashion, home goods, gadgets, and jewellery with our instant credit catalogues. Sign up in just a few minutes and start shopping on your mobile right away.

With our lightning-fast sign up process, you can be browsing our extensive catalogue of products in just three minutes. And with 100% acceptance on all applications, everyone is a winner!

At Accepted Credit, we are proud of our excellent customer service and customer care. Our goal is to make your catalogue shopping experience as easy and convenient as possible, even for those with a less-than-perfect credit history.

We understand that having a damaged credit score can be a challenge, which is why we offer 0% finance and no credit checks. This way, you can purchase the items you need now and pay for them later, without worrying about your credit history.

Join thousands of happy customers today and take advantage of our instant credit catalogue to make your shopping experience even easier and more convenient.

Which Credit reference agency will the Catalogue companies check?

When you apply for a pay monthly catalogue with credit, your application will be subject to several assessments, including identity checks, credit checks, and affordability checks. If you’re curious about which credit reference agency a pay monthly catalogue is likely to use, you can consult the table provided. Knowing this information can be valuable if your credit reports are displaying differing credit scores.

Yes Catalogue: A Second Chance for Credit

All Credit Scores Welcome

Yes Catalogue accepts customers with various credit scores, so you can be confident that you will be approved.

No Judgment Based on Credit History

Different from other catalogue companies, Yes Catalogue does not use your credit history as a factor in determining your eligibility.

Flexible Repayment Options

You have the control to choose when you want to make payments on your Yes Catalogue account, which you can open in just three minutes after completing the application.

Guaranteed Catalogue Credit Account with Yes Catalogue

Your Yes Catalogue account and access to the latest products are just a few minutes away, guaranteed.

Instant Approval without a Credit Check

Yes Catalogue offers an alternative solution for those with bad credit or who prefer not to undergo a credit check.

A New Way to Look at Credit with Yes Catalogue

With just your debit card, Yes Catalogue offers a new way to manage your credit and make purchases. Say goodbye to the hassle of traditional credit checks and poor credit scores.

Discover Simply Yours, the Home Shopping Brand for Quality Lingerie

Simply Yours is a brand under JD Williams and Company Limited, known for its quality lingerie for women of all sizes. Realising that not all women have a slim physique, Simply Yours caters to the full-figure market in the UK. With more women gaining confidence and rejecting the media’s notion that only thin women are beautiful, Simply Yours understands the lingerie desires of women of all shapes and sizes.

Enjoy 10% off and Free Delivery with Simply Yours Discount Codes

As a new customer, use discount code CQHC5 at checkout on the Incentives page to receive 10% off and free delivery.

Bras and Knickers for Full-Figure Women

Simply Yours empowers full-figure women with beautifully crafted bras and knickers. The company’s designers know that big bras can still be stylish, using luxurious materials to create both functional and sexy lingerie. The Simply Yours website offers a wide selection of undergarments, including briefs, shorts, and thongs, made with delicate fabrics to suit all fashion tastes.

Assistance with Sizing and Fitting

Many full-figure women are unaware of their correct bra size, settling for the largest size available in lingerie shops. Simply Yours provides guidance on bra sizing through its website, which includes bra size guides, fitting tips, and videos. Additionally, the bra style guide helps women determine the appropriate fabrics and styles for their figure.

Top Lingerie Brands at Simply Yours

Simply Yours offers a range of famous lingerie brands, including Curvy Kate, Zoggs, Freya, Gossard, Gok Kwan, Panache, Miss Mandalay, and Masquerade. These brands provide superb fit and support, with a size range of 30 to 50 and cup size range of A to JJ.

Expand Your Lingerie Collection with Simply Yours

In addition to lingerie, Simply Yours also offers swimwear, nightwear, shapewear, and clothing for plus size women. If you’re on a budget, consider opening a personal account with Simply Yours to spread the cost and shop for all your lingerie needs.

How does one become a customer of Fashion World?

“Fashion World: A Home Shopping Company Providing Affordable and Flattering Outfits for All”

Fashion World is a home shopping company that offers a diverse selection of affordable and figure-flattering outfits for all occasions, styles, ages, and sizes. It is a subsidiary of J D Williams and Co, the UK’s leading home shopping company.

Fashion World 2012 Active Discount Codes & Voucher Codes:

- Enjoy a 20% discount on your first order of fashion, footwear, and lingerie by using the Discount Code WWYL9.

Fashion World is proud to be:

- Budget-friendly, offering sales and value packs.

- Figure-flattering, with its voluptuous, sculpting, and fitting clothing lines.

- On-trend, with its constantly changing styles to stay up-to-date with popular trends.

- Size-inclusive, offering a wide range of sizes, from petite to tall and plus sizes.

Additionally, the website’s front page features an array of deals and bargains on home and electrical goods, men’s fashion, width-fitting footwear, and New Joe Browns.

With these new and shapely designs, you are just a click away from finding effective and stylish slimming clothes. The Fashion World website and online catalogue make it easy to order from the comfort of your own home, with a step-by-step guide for new customers.

Ordering is a simple process: create an account, select the items you want with your preferred options and sizes, click “Add to Bag” and “Go to Checkout”, fill in the necessary details, and place the order. The HELP and FAQ pages provide guidance for any complications and a more in-depth process.

In conclusion, Fashion World provides its customers with numerous choices and more convenient ways to purchase its products. With its online catalogue, shopping is made easier and more accessible for those who prefer to shop from home.

Freemans

Freemans is a well-known online fashion store offering a wide range of clothing and accessories for men, women and children. They also have a comprehensive collection of home appliances. Established in 1905, the company has collaborated with various brands including Kaleidoscope, Lascana, Swimwear365 and Gifts365 to bring the latest fashion trends to customers.

By creating a personal account, customers are eligible for a 25% discount on their first order.

In terms of financing, Freemans has a competitive 34.9% APR variable, which is lower than many other similar retailers. To make the shopping experience more convenient, Freemans offers multiple payment options.

More Credit Catalogue Shopping Guides

- Clearpay App Review: Pay Monthly No Credit Check Shopping with Clearpay in the UK

- Simply Be Catalogue Review: Pay Monthly No Credit Check Fashion in the UK

- Accepted Mobile Catalogue Review: Pay Monthly No Credit Check Mobile Options in the UK

- Sunshine Mobile Catalogue Review: Pay Monthly No Credit Check Mobile Deals in the UK

- Jacamo Catalogue Review: Pay Monthly No Credit Check Fashion in the UK

- Studio Catalogue Review: Pay Monthly No Credit Check Shopping in the UK

- Swimwear365 Catalogue Review: Pay Monthly No Credit Check Swimwear in the UK

- Flava Catalogue Review: Pay Monthly No Credit Check Catalogue Features in the UK

- Vertbaudet Catalogue Review: Pay Monthly No Credit Check Details in the UK

- Hughes Rental Catalogue Review: Pay Monthly No Credit Check Insights in the UK

- Catalogues for People with CCJs: A Comprehensive Guide

- Grattan Catalogue Review: Pay Monthly No Credit Check Selections in the UK

- Witt International Catalogue Review: Pay Monthly No Credit Check Offers in the UK

- PremierMan Catalogue Review: Pay Monthly No Credit Check Choices in the UK

- PerfectHome Catalogue Review: Pay Monthly No Credit Check Options in the UK

- Lookagain Catalogue Review: Pay Monthly No Credit Check Analysis in the UK

- La Redoute Catalogue Review: Pay Monthly No Credit Check Benefits in the UK

- Kaleidoscope Catalogue Review: Pay Monthly No Credit Check Features in the UK

- JD Williams Catalogue Review: Pay Monthly No Credit Check Highlights in the UK

- Fashion World Catalogue Review: Pay Monthly No Credit Check Trends in the UK

- Dial a TV Catalogue Review: Pay Monthly No Credit Check Experiences in the UK

- Brighthouse Catalogue Review: Pay Monthly No Credit Check Review in the UK

- Bonprix Catalogue Review: UK Pay Monthly No Credit Check Catalogue Details

- Argos Catalogue Review: Pay Monthly No Credit Check Solutions in the UK

- Homestyle Catalogue Review: UK Pay Monthly No Credit Check Insights

- Freemans Catalogue Review: Pay Monthly No Credit Check Deals in the UK

- Marisota Catalogue Review: Pay Monthly No Credit Check Choices in the UK

- Yes Catalogue Review: Explore UK Pay Monthly No Credit Check Options

- Food Pay Monthly No Credit Check – Convenient Deals Await

- Bluetooth Headphones Pay Monthly No Credit Check – Wireless Financing Available

- Apple Watch Pay Monthly No Credit Check – Stylish Payment Options

- Mini Electric Scooter Pay Monthly No Credit Check – Eco-Friendly Deals Await

- Nintendo Switch Pay Monthly No Credit Check – Gaming Financing Available

- Hoovers Pay Monthly No Credit Check – Versatile Payment Options

- Appliances Pay Monthly No Credit Check – Convenient Deals Await

- Washing Machines Pay Monthly No Credit Check – Reliable Financing Available

- Tablets Pay Monthly No Credit Check – Diverse Payment Options

- Laptops Pay Monthly No Credit Check – Modern Deals Await

- iPads Pay Monthly No Credit Check – Advanced Financing Available

- Tumble Dryers Pay Monthly No Credit Check – Efficient Payment Options

- Tables Chairs Pay Monthly No Credit Check – Practical Deals Await

- Sofas Pay Monthly No Credit Check – Comfortable Financing Available

- Garden Furniture Pay Monthly No Credit Check – Stylish Payment Options

- Furniture Pay Monthly No Credit Check – Quality Deals Await

- Fridge Freezers Pay Monthly No Credit Check – Convenient Financing Available

- Flooring Pay Monthly No Credit Check – Versatile Payment Options

- Clothes Pay Monthly No Credit Check – Fashionable Deals Await

- Cookers Pay Monthly No Credit Check – Affordable Financing Available

- Carpets Pay Monthly No Credit Check – Varied Payment Options

- Blinds Pay Monthly No Credit Check – Attractive Deals Await

- Beds Pay Monthly No Credit Check – Easy Financing Available

- Contract Phones Pay Monthly No Credit Check – Diverse Payment Options

- Xbox Series Pay Monthly No Credit Check – Exciting Deals Await

- PS4 Pay Monthly No Credit Check – Convenient Options Available

- PS5 Pay Monthly No Credit Check – Flexible Payment Options

- Pay Monthly No Credit Check Game Consoles – Exclusive Deals Await

- Pay Monthly No Credit Check TV – Affordable Options Available

- Pay Monthly No Credit Check Tablets – Explore Payment Options